Important information: Government advice and travel restrictions may affect your policy coverage. Before your trip, check our travel alerts

Earn and use Qantas Points

Our travel insurance policies

International Comprehensive Travel Insurance

This is a summary of cover only. Read the Product Disclosure StatementOpens in a new tab or window for full details of benefits, limits, sub-limits, exclusions and key risks.

Australian Comprehensive Travel Insurance

This is a summary of cover only. Read the Product Disclosure StatementOpens in a new tab or window for full details of benefits, limits, sub-limits, exclusions and key risks.

Annual Multi Trip

This is a summary of cover only. Read the Product Disclosure StatementOpens in a new tab or window for full details of benefits, limits, sub-limits, exclusions and key risks.

Already have a Qantas Travel Insurance policy?

Manage your policy

To change or cancel your policy, refer to your confirmation email for instructions or contact us.

Make a claim

Claims can be lodged 24 hours a day, 7 days a week. They can be lodged in Australia, overseas or when you return home.

Travel support

See the latest travel alerts related to our travel insurance coverage or if you need help while travelling contact our Emergency Assistance team.

Complaints and feedback

We recognise sometimes things go wrong, and when they do, we want you to tell us so we can try and make them right.

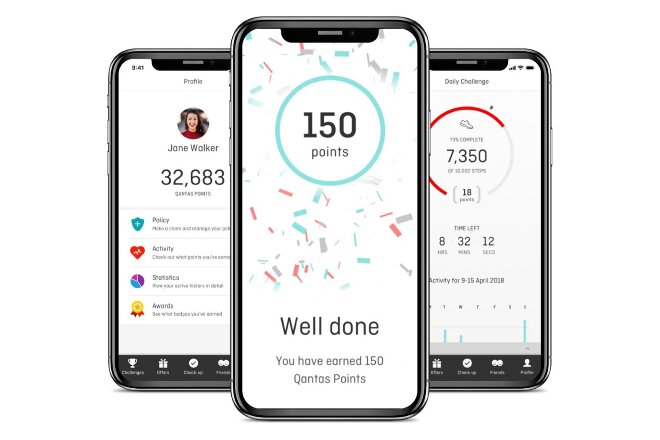

Qantas Insurance and the Qantas Wellbeing App

Health. Car. Home. Travel. Wellbeing.

Qantas InsuranceOpens in a new tab or window can provide cover for your health, car, home, and travel - all with the added benefit of Qantas Points.

All Qantas Frequent Flyer members enjoy free access to the Qantas Wellbeing AppOpens in a new tab or window where you can earn Qantas Points for everyday activities like walking, cycling and even sleeping. Plus, if you hold one of our eligible Qantas Insurance products, you could earn even more points for selected activities in the App.

Important Information

Qantas Travel Insurance is issued by AIG Australia Limited ABN 93 004 727 753, AFSL 381686 (“AIG”). Qantas Airways Limited is an authorised representative (AR 261363) of AIG. This is general advice only and your objectives, financial situation or needs have not been taken into account. You should consider whether the advice is suitable for you and your personal circumstances. Before making any decision to buy the travel insurance, you should read the Product Disclosure Statement (PDS), Target Market Determination (TMD) and Financial Services Guide (FSG)

You must be a member of the Qantas Frequent Flyer program to earn and use Qantas Points. A joining fee may apply. Membership and points are subject to the Qantas Frequent Flyer program terms and conditions

Disclaimer: ^ Qantas Frequent Flyer (QFF) members who are the primary holder of a valid Qantas Travel Insurance policy purchased between 27 November 2024 and 11:59pm (AEDT) 6 March 2025 will earn a maximum of 15,000 Qantas Points with a premium value of A$1,000 and over. Each Qantas Travel Insurance policy has a maximum number of points that can be earned upon purchase. The primary holder of any valid Qantas Travel Insurance policy will also earn 1 Qantas Point per A$1 value of the premium paid. For single trip policies, you will be eligible for these points from your departure date based on the price of the policy you hold at that time. For annual multi trip policies, you will be eligible for these points from the policy start date based on the price of the policy you hold at that time. Please note points may take up to 6 weeks from these dates to be credited to your QFF account. Qantas may amend or withdraw these offers at any time.

Disclaimer: ~ Children under 12 named on the policy can be covered for free provided they are travelling with an adult on a trip.

Disclaimer: % Qantas Annual Multi Trip Travel Insurance policies provide cover for an unlimited number of trips within Australia and overseas in a 12-month period as long as each trip has a maximum duration of 45 days, and starts and ends at your home in Australia. Trips within Australia must be more than a 100 km radius from your home or usual place of work in Australia.

Disclaimer: * Terms and conditions, limitations and exclusions apply. The information on this webpage is factual and of a general nature only and does not consider your personal objectives, financial situation or particular needs. You should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) at qantas.com/insurance to decide if the product is right for you. Home and Contents Insurance is not available in Northern Territories, North Queensland or Northern Western Australia. Car and Home issuer: Auto & General Insurance Company Ltd (insurance arranged by Qantas Airways Limited AR 261363 (‘Qantas’) for Auto & General Services Pty Ltd AFSL 241411). Travel issuer: AIG Australia Limited (‘AIG’) AFSL 381686 (travel insurance arranged by Qantas for AIG as an Authorised Representative AR 261363). Health issuer: nib health funds limited, a registered private health insurer (insurance arranged by Qantas). Qantas receives commissions in respect of these products.

Disclaimer: # The Qantas Wellbeing App (the App) is available to Qantas Frequent Flyer members aged 13 years of age and over. The number of Qantas Points offered on activities in the App may vary depending on the Eligible Qantas Products the member holds. See the Wellbeing Program Terms and Conditions for details. Membership and Qantas Points are subject to the Qantas Frequent Flyer terms and conditions A joining fee usually applies, however this will be waived when signing up via the App.

Disclaimer: + Qantas Frequent Flyer (QFF) members can use Qantas Points to acquire a Qantas Travel Insurance policy online. Members cannot use Qantas Points to acquire a Qantas Travel Insurance policy through the call centre on 13 49 60. Members must have the total Qantas Points value available in their QFF account and cannot use Points Plus Pay. The number of Qantas Points required to take out a Qantas Travel Insurance policy is subject to change.